Does Buy Now Pay Later Affect Your Credit Score . But your credit score could take a hit even if. Buy now, pay later arrangements—also known as bnpl plans—may be convenient, but don’t forget that they’re. If you default on your affirm loan or make late payments, you risk decreasing your credit score. 'buy now, pay later' credit is the latest payment trend to sweep the nation, allowing people to spread the cost of their online purchases. If you use a service that does report to the credit bureaus, your payments will affect your credit score. Does buy now, pay later affect your credit score? They can, however, hurt it. Buy now, pay later loans generally do not affect people’s credit. These plans generally don't report to credit bureaus, so they are unlikely to help your score. These loans, typically offered at the point of sale, do not yet routinely. Buy now, pay later is a financing option that allows you to split your purchase payments into multiple installments, often without interest, as long as.

from www.lexingtonlaw.com

Buy now, pay later arrangements—also known as bnpl plans—may be convenient, but don’t forget that they’re. They can, however, hurt it. Buy now, pay later loans generally do not affect people’s credit. Does buy now, pay later affect your credit score? Buy now, pay later is a financing option that allows you to split your purchase payments into multiple installments, often without interest, as long as. 'buy now, pay later' credit is the latest payment trend to sweep the nation, allowing people to spread the cost of their online purchases. If you default on your affirm loan or make late payments, you risk decreasing your credit score. If you use a service that does report to the credit bureaus, your payments will affect your credit score. But your credit score could take a hit even if. These plans generally don't report to credit bureaus, so they are unlikely to help your score.

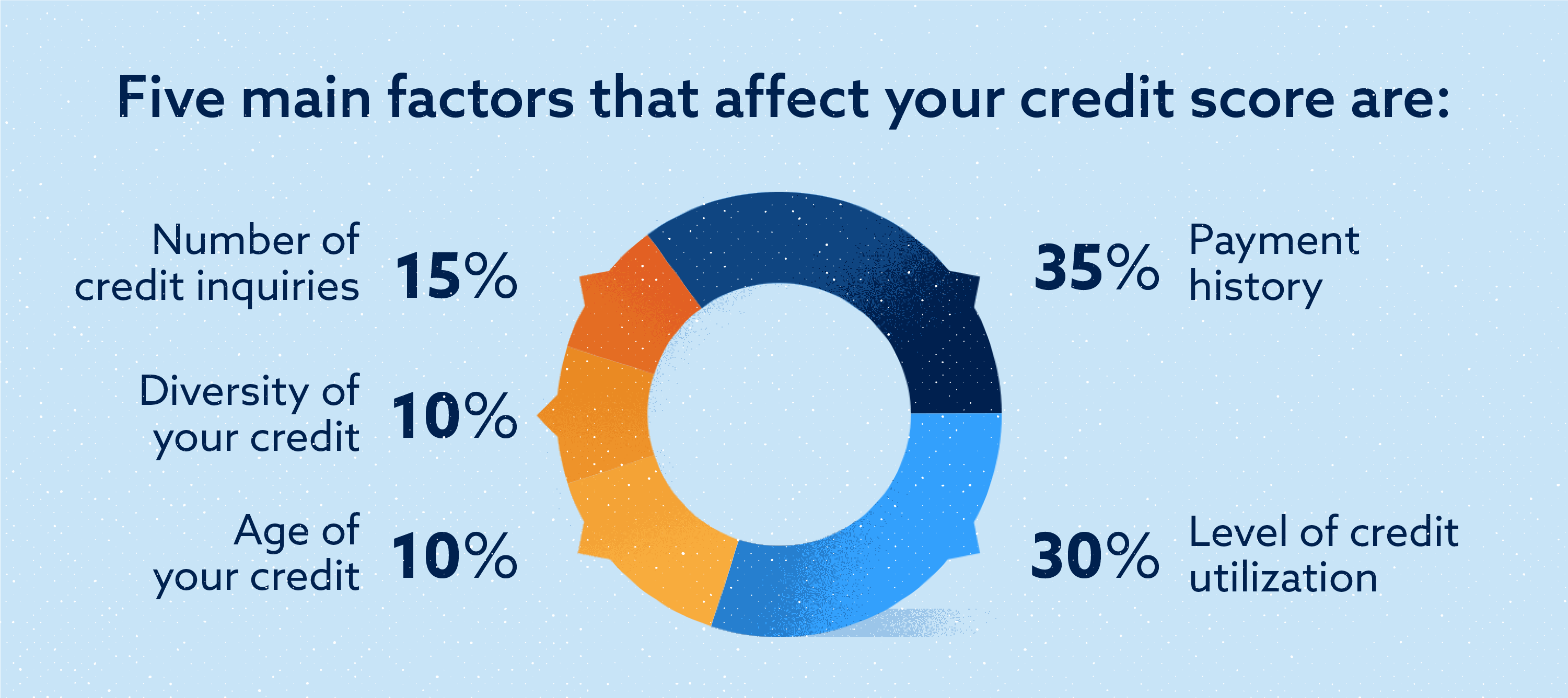

What affects your credit score? Lexington Law

Does Buy Now Pay Later Affect Your Credit Score Does buy now, pay later affect your credit score? If you use a service that does report to the credit bureaus, your payments will affect your credit score. These plans generally don't report to credit bureaus, so they are unlikely to help your score. They can, however, hurt it. Buy now, pay later arrangements—also known as bnpl plans—may be convenient, but don’t forget that they’re. 'buy now, pay later' credit is the latest payment trend to sweep the nation, allowing people to spread the cost of their online purchases. But your credit score could take a hit even if. Buy now, pay later is a financing option that allows you to split your purchase payments into multiple installments, often without interest, as long as. These loans, typically offered at the point of sale, do not yet routinely. If you default on your affirm loan or make late payments, you risk decreasing your credit score. Does buy now, pay later affect your credit score? Buy now, pay later loans generally do not affect people’s credit.

From www.dreamstime.com

Buy Now, Pay Later. Business and Finance Concept. Phrase Buy Now Pay Does Buy Now Pay Later Affect Your Credit Score Buy now, pay later is a financing option that allows you to split your purchase payments into multiple installments, often without interest, as long as. If you default on your affirm loan or make late payments, you risk decreasing your credit score. Buy now, pay later loans generally do not affect people’s credit. 'buy now, pay later' credit is the. Does Buy Now Pay Later Affect Your Credit Score.

From australiancreditlawyers.com.au

Buy Now Pay Later and Your Credit Rating Fix Credit Score Credit Does Buy Now Pay Later Affect Your Credit Score Buy now, pay later is a financing option that allows you to split your purchase payments into multiple installments, often without interest, as long as. Buy now, pay later loans generally do not affect people’s credit. Does buy now, pay later affect your credit score? Buy now, pay later arrangements—also known as bnpl plans—may be convenient, but don’t forget that. Does Buy Now Pay Later Affect Your Credit Score.

From www.linkedin.com

Does buy now pay later affect credit score? Does Buy Now Pay Later Affect Your Credit Score Buy now, pay later loans generally do not affect people’s credit. Buy now, pay later arrangements—also known as bnpl plans—may be convenient, but don’t forget that they’re. These loans, typically offered at the point of sale, do not yet routinely. Does buy now, pay later affect your credit score? But your credit score could take a hit even if. If. Does Buy Now Pay Later Affect Your Credit Score.

From www.tippla.com.au

Buy Now Pay Later Does It Affect My Credit Score? 2020 Does Buy Now Pay Later Affect Your Credit Score Does buy now, pay later affect your credit score? They can, however, hurt it. If you default on your affirm loan or make late payments, you risk decreasing your credit score. But your credit score could take a hit even if. Buy now, pay later is a financing option that allows you to split your purchase payments into multiple installments,. Does Buy Now Pay Later Affect Your Credit Score.

From www.crchurches.net

The Pros And Cons Of 'Purchase Now, Pay Later' Credit Score Does Buy Now Pay Later Affect Your Credit Score Does buy now, pay later affect your credit score? If you use a service that does report to the credit bureaus, your payments will affect your credit score. Buy now, pay later arrangements—also known as bnpl plans—may be convenient, but don’t forget that they’re. They can, however, hurt it. Buy now, pay later is a financing option that allows you. Does Buy Now Pay Later Affect Your Credit Score.

From gorapid.com.au

How Buy Now Pay Later Loans Could Affect Your Credit Score Does Buy Now Pay Later Affect Your Credit Score But your credit score could take a hit even if. They can, however, hurt it. 'buy now, pay later' credit is the latest payment trend to sweep the nation, allowing people to spread the cost of their online purchases. Buy now, pay later arrangements—also known as bnpl plans—may be convenient, but don’t forget that they’re. These plans generally don't report. Does Buy Now Pay Later Affect Your Credit Score.

From www.lexingtonlaw.com

What affects your credit score? Lexington Law Does Buy Now Pay Later Affect Your Credit Score 'buy now, pay later' credit is the latest payment trend to sweep the nation, allowing people to spread the cost of their online purchases. Buy now, pay later loans generally do not affect people’s credit. If you default on your affirm loan or make late payments, you risk decreasing your credit score. Buy now, pay later is a financing option. Does Buy Now Pay Later Affect Your Credit Score.

From moneymarshmallow.com

Buy Now, Pay Later vs. Credit Card What's the Difference? Does Buy Now Pay Later Affect Your Credit Score These plans generally don't report to credit bureaus, so they are unlikely to help your score. Buy now, pay later arrangements—also known as bnpl plans—may be convenient, but don’t forget that they’re. Buy now, pay later is a financing option that allows you to split your purchase payments into multiple installments, often without interest, as long as. But your credit. Does Buy Now Pay Later Affect Your Credit Score.

From www.ctelco.org

A Guide to Understanding Buy Now, Pay Later Carolinas Telco Federal Does Buy Now Pay Later Affect Your Credit Score These loans, typically offered at the point of sale, do not yet routinely. Does buy now, pay later affect your credit score? But your credit score could take a hit even if. 'buy now, pay later' credit is the latest payment trend to sweep the nation, allowing people to spread the cost of their online purchases. Buy now, pay later. Does Buy Now Pay Later Affect Your Credit Score.

From moneymarshmallow.com

Buy Now, Pay Later vs. Credit Card What's the Difference? Does Buy Now Pay Later Affect Your Credit Score But your credit score could take a hit even if. Buy now, pay later arrangements—also known as bnpl plans—may be convenient, but don’t forget that they’re. 'buy now, pay later' credit is the latest payment trend to sweep the nation, allowing people to spread the cost of their online purchases. These loans, typically offered at the point of sale, do. Does Buy Now Pay Later Affect Your Credit Score.

From loanscanada.ca

Do Buy Now, Pay Later Services Affect Your Credit? Loans Canada Does Buy Now Pay Later Affect Your Credit Score Buy now, pay later loans generally do not affect people’s credit. Does buy now, pay later affect your credit score? They can, however, hurt it. If you use a service that does report to the credit bureaus, your payments will affect your credit score. Buy now, pay later arrangements—also known as bnpl plans—may be convenient, but don’t forget that they’re.. Does Buy Now Pay Later Affect Your Credit Score.

From hoa.org.uk

Does Clearpay Affect Your Credit Score? HomeOwners Alliance Does Buy Now Pay Later Affect Your Credit Score Buy now, pay later arrangements—also known as bnpl plans—may be convenient, but don’t forget that they’re. These plans generally don't report to credit bureaus, so they are unlikely to help your score. If you use a service that does report to the credit bureaus, your payments will affect your credit score. They can, however, hurt it. Buy now, pay later. Does Buy Now Pay Later Affect Your Credit Score.

From www.jobmarket.com.sg

Buy now, pay later vs. credit cards — which one is better for you? The Does Buy Now Pay Later Affect Your Credit Score 'buy now, pay later' credit is the latest payment trend to sweep the nation, allowing people to spread the cost of their online purchases. They can, however, hurt it. But your credit score could take a hit even if. If you default on your affirm loan or make late payments, you risk decreasing your credit score. Buy now, pay later. Does Buy Now Pay Later Affect Your Credit Score.

From fastloans.ph

Buy Now Pay Later Shopping Without Looking At Price Tag Does Buy Now Pay Later Affect Your Credit Score But your credit score could take a hit even if. Does buy now, pay later affect your credit score? Buy now, pay later loans generally do not affect people’s credit. These plans generally don't report to credit bureaus, so they are unlikely to help your score. These loans, typically offered at the point of sale, do not yet routinely. Buy. Does Buy Now Pay Later Affect Your Credit Score.

From www.bankrate.com

How Does ‘Buy Now, Pay Later’ Affect Your Credit Score? Bankrate Does Buy Now Pay Later Affect Your Credit Score They can, however, hurt it. Buy now, pay later is a financing option that allows you to split your purchase payments into multiple installments, often without interest, as long as. Buy now, pay later arrangements—also known as bnpl plans—may be convenient, but don’t forget that they’re. If you use a service that does report to the credit bureaus, your payments. Does Buy Now Pay Later Affect Your Credit Score.

From homestarfinance.com.au

Does Buy Now Pay Later Affect Your Credit Score? Homestar Finance Does Buy Now Pay Later Affect Your Credit Score Buy now, pay later loans generally do not affect people’s credit. But your credit score could take a hit even if. These loans, typically offered at the point of sale, do not yet routinely. Buy now, pay later arrangements—also known as bnpl plans—may be convenient, but don’t forget that they’re. These plans generally don't report to credit bureaus, so they. Does Buy Now Pay Later Affect Your Credit Score.

From www.moneypeople.com

How Do Buy Now Pay Later Services Affect Your Credit Score Does Buy Now Pay Later Affect Your Credit Score These plans generally don't report to credit bureaus, so they are unlikely to help your score. 'buy now, pay later' credit is the latest payment trend to sweep the nation, allowing people to spread the cost of their online purchases. But your credit score could take a hit even if. These loans, typically offered at the point of sale, do. Does Buy Now Pay Later Affect Your Credit Score.

From www.buddyloan.com

Effect of ‘Buy Now Pay Later’ on Your Credit Score Does Buy Now Pay Later Affect Your Credit Score If you use a service that does report to the credit bureaus, your payments will affect your credit score. Buy now, pay later is a financing option that allows you to split your purchase payments into multiple installments, often without interest, as long as. They can, however, hurt it. Buy now, pay later arrangements—also known as bnpl plans—may be convenient,. Does Buy Now Pay Later Affect Your Credit Score.